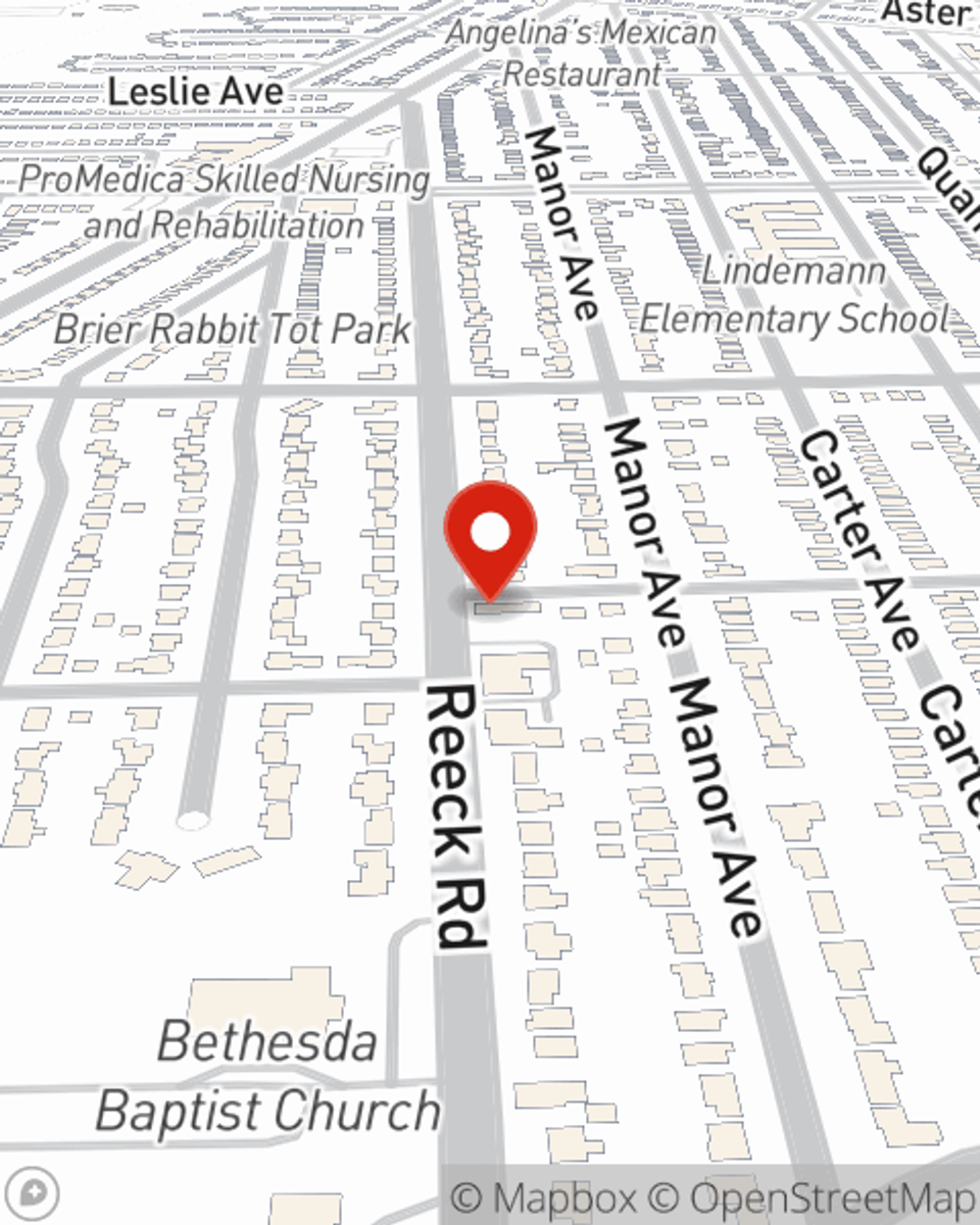

Business Insurance in and around Allen Park

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Your Search For Reliable Small Business Insurance Ends Now.

Preparation is key for when an accident happens on your business's property like an employee getting injured.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict natural disasters or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like worker's compensation for your employees and errors and omissions liability. Fantastic coverage like this is why Allen Park business owners choose State Farm insurance. State Farm agent Dawn Pullis can help design a policy for the level of coverage you have in mind. If troubles find you, Dawn Pullis can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and get in touch with State Farm agent Dawn Pullis to investigate your small business insurance options!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Dawn Pullis

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.